Hey, friends—I’m thinking out loud with limited edits on this one so enjoy the rare form. Welcome to all the new subscribers!! If you’re new here, make sure you subscribe below.

Meta acquired Scale AI for a trillion dollars yesterday. Such impeccable timing—thank you, Zuck, for very publicly validating an idea I’ve let percolate in group chats for far too long.

For nearly two years now, I’ve been obsessed with modern consumer founders. These digital savants understand consumer behavior and, having figured out growth without working early at Facebook, they launch a suite of apps that make millions within months. Often, these small teams iterate app ideas and their growth strategy until they find a cash cow to underwrite further experimentation. Thanks to AI, they are capital-efficient and reach profitability quickly without venture capital. Of course, there are a few venture-backed companies like this, and they look a lot like Meta.

All the tech giants are conglomerates hiding in plain sight

Meta is a conglomerate. Okay, okay—I can hear all the tax and legal guys clamoring to “well, actually” me and, to that I say, pipe down! Technically, it doesn’t fit the traditional definition, but the label feels even more apt after the Scale AI stake: $14 billion (yes, billion) for 49% ownership.

Meta owns and manages several businesses: Facebook, Instagram, Messenger, Threads, WhatsApp, and Reality Labs. Unlike a traditional conglomerate, Meta’s businesses are diverse but related in that they’re focused on technology.

The same can be said for Amazon (AWS, Whole Foods, Twitch), Microsoft (GitHub, LinkedIn), and Alphabet (Google, Waymo, YouTube), of course. These conglomerates came to be through:

Internal R&D. Waymo. Need I say more?

Acquisitions. Whole Foods cost Amazon $13.7 billion, but at least they own 100%.

As I reflected on the state of venture capital in the last year (DM for hot takes), I realized startups can embrace the conglomerate strategy right out of the gate.

The Barbell Framework for AI conglomerates

In the Barbell strategy, VCs make sure bets, which are more conservative and less risky. They also throw in a wildcard here and there, investments that are speculative but with high upside. The Middleness is no man's land; you don’t want to be there. This concept can be applied to our new crop of AI companies:

Sure Bets (or, the R&D conglomerates)

For anyone wondering why Anysphere (Cursor) is a sure bet, two words: power laws. The company also built one of the most impressive coding models out. Originally structured as an applied research lab, Anysphere is working on automating coding and owns the Cursor product used by developers everywhere. I would be surprised if they didn’t introduce or explore another coding product in the coming year(s) that leverages their research and models. This would be similar to OpenAI (ChatGPT, Sora, io) and Anthropic (Claude app & models). Eric Vishria, GP at Benchmark, described this new approach well—

One of the things that is really different in the AI world versus the SaaS world, is that in the SaaS world, over and over again, you had people who really understood the customer. And the problem. And then they understood a domain. They understood what the technology was more or less capable of. […] And they were just like, here's a better version. And that evolved a little bit over time in SaaS land. But that's what it is.

And this is almost diametrically opposite of product development in the AI era. When I look at the teams that are having the most success today, they have intimate knowledge of the models. They are right on the frontier of understanding which models are better at what, and why, and when. And what they're going to be good at and what they're not going to be good at.

And what they're spending their time on, is figuring out how do I apply this capability of this model to this domain or to this user. So they're actually working inside out or technology out, versus customer problem in. And of course, they understand the customer problem. And a lot of times they have firsthand knowledge of it. But they're really close to the metal and capability, and they're applying it. And I think this is a really different way to develop products than in SaaS. — Eric Vishria on The Peel.

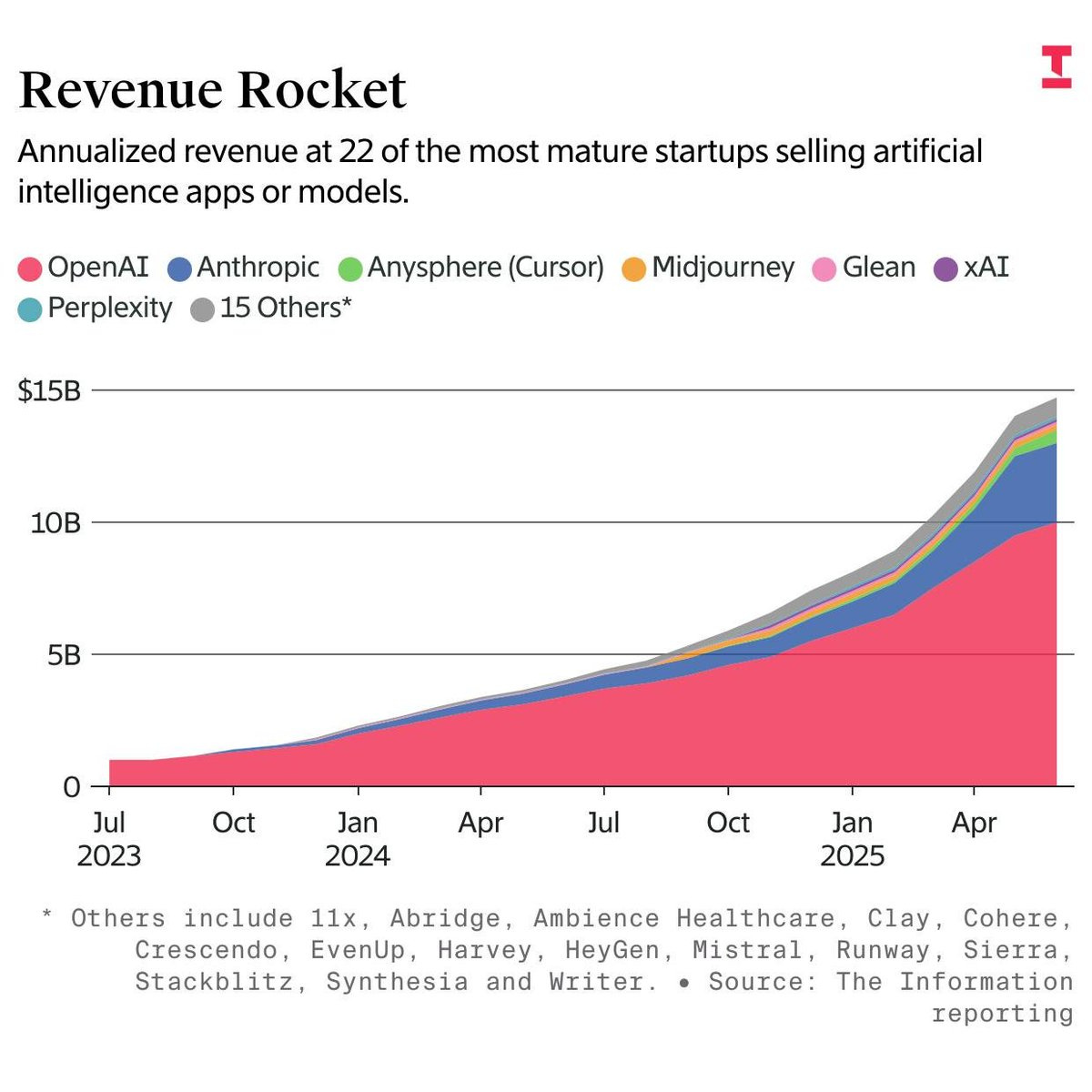

These companies are research labs at their core. They’re building seminal models that they can apply across industries and customer problems. What they’re are doing is working. OpenAI is at $10B in annualized revenue with Anthropic and Anysphere (Cursor) trailing close behind. Anysphere (Cursor) could focus on their sole product for years to come and they’d be fine but as a lab, I expect they have more in store.

Middleness (or, SaaS)

What else is there to say here, honestly?

Wildcards (or, the Apps conglomerates)

Developers don’t need to raise venture capital to build a profitable business. I’ve been following bootstrapped projects and unlike traditional product studios, acquisitions are happening bellow the surface. Oleve, a New York-based company with a team of 5, grew to 4.5M users across two products (Quizard, Unstuck AI) and reached $6M ARR by February (up from $1M in a year). Meanwhile, 24Labs is building and acquiring products (Crayo) and Playa Vista launched Rayz before selling it to another company and shutting down.

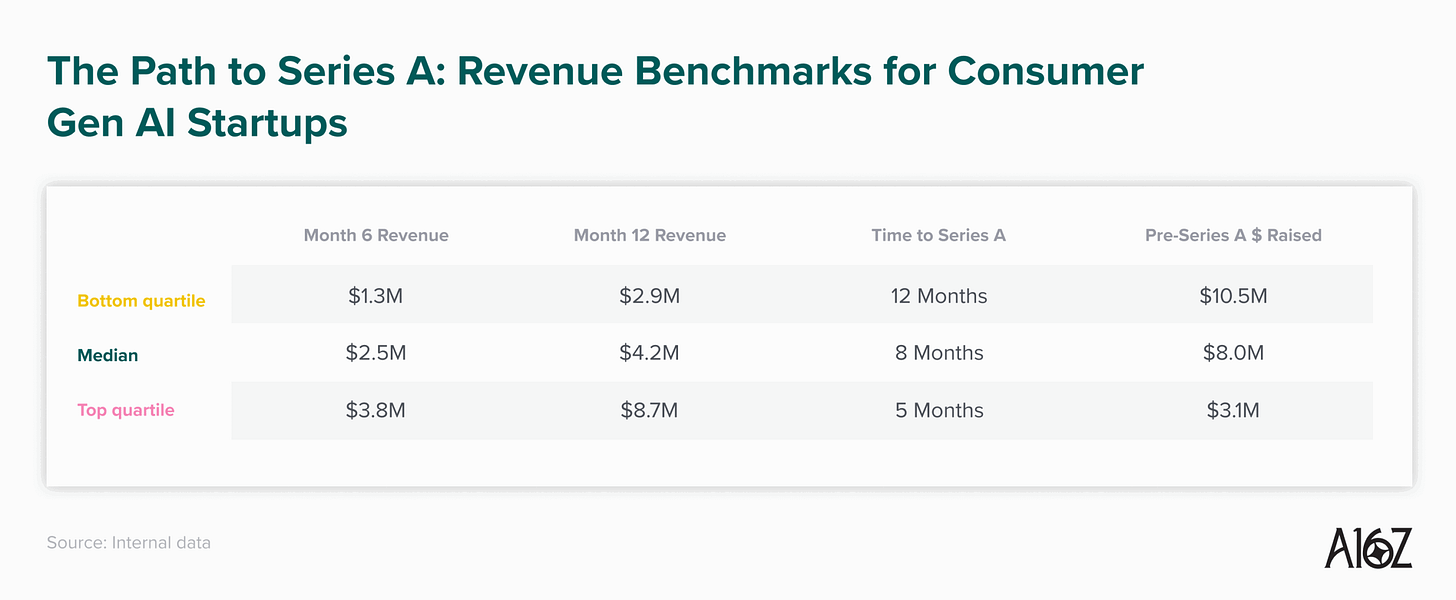

Funny enough, the companies that do raise venture are generating less revenue on average, according to a16z.

A notable venture-backed company is wildcard Amo, which describes itself as such:

Our first app, ID, brought a new take on the social profile […]. And our second app, Bump, is the best map for friends [..]. Together, the apps form the beginning of a new kind of social company. One that exists across multiple apps, but only one you. And with many more ideas for new ways to bring you closer to your friends. We’re going to experiment, build, re-build again, and no doubt get lots wrong along the way. But we hope that what we get right earns its place on your home screen — as a new collection of apps that serve you and your friends above all else.

A new collection of apps housed under one company. If it looks like a Meta and quacks like a Meta, it might be a Meta (save the billions in revenue)! Another venture-backed example is Infinity Constellation, which has 8 subsidiary startups. According to Upstarts Media, Infinity finds founders “who are experts within a certain domain to build an AI services business in their area, sharing back-end software and operations with the rest of Infinity’s portfolio and getting a boost from exposure to its customer base and founder peers.” Does this sound familiar? The company’s portfolio is at a combined $7.1 million in annualized revenue with an expected $15 million by the end of 2025. They raised $17 million from VCs.

Why AI startups should be conglomerates

Biotech/longevity, some defense, and even hardware are all interesting. SaaS? Not to hit you with another quote, but it’s Charles Hudson so I must!

Even in an industry with many firms, I suspect most of the industry’s dollars are going to the same themes regardless of which firm writes the check. And, in my experience, most themes only produce a very small number of really meaningful winners. I worry about what this means for the venture ecosystem.

This job used to be about hunting for the most revolutionary, high-risk ideas. From the earliest internet days to the social media revolution, these ideas were so visionary that they sometimes sounded unbelievable. That promise of invention brought us the most formidable tech companies of this generation. — What Does it Mean to Be a Venture Capitalist Today?

We have our foundational model giants, though it’d be thrilling to see someone overtake Cursor for example. What comes next? The app layer that everyone is talking about? What does that look like? The App Store charts are lined with companies that won’t take VC money (Finch) or don’t really need it (Stardust). These companies are making delightful apps that I and millions of people love. The way I see it, builders can assemble a small team, launch an app or two, growth hack it, monetize along the way, and iterate until they find a flagship. You can opt into venture funding with this approach, but with shared resources (team, users, networks) you may not need it.

This is one of the few times I’ve just riffed on a nascent idea and maybe I’ll write a follow-up down the line. If you have any thoughts or just want to jam on it, definitely reach out!

dig!

related:

https://getlightswitch.substack.com/p/consumer-software-from-single-bets

Loved this Holyn